indiana real estate tax lookup

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad. This is much lower than the national average of 107.

Treasurer Johnson County Indiana

Use this application to.

. County-City Building 227 West Jefferson Blvd Suite 722 South Bend IN 46601 Tax bill information and link to view your tax. Main Street Crown Point IN 46307 Phone. Make and view Tax Payments get current Balance Due.

Choose from the options below. Various Vigo County offices coordinate the assessment and payment of property taxes. Co llection of property taxes real estate-personal-mobile home.

For best search results enter a partial street name and partial owner name ie. The major responsibility of the Treasurers Office is the collection of property taxes. Our staff is equally devoted to achieving our goal of fair and equitable.

The average national rate is. Lake County is the highest taxed county. Property Reports and Tax Payments.

In Indiana the average property tax bill is only 1163 per year. Taxpayers may check their TS 1 form under Table 5 to verify they are receiving the Homestead Credit. The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes.

Printview a tax bill or pay a tax bill. Printview the County Assessors Form 11 when available. Taxes are due and payable in two 2 equal installments on or before May 10 and.

The states effective property tax rate is 11 while the national average is 107. Tax deadline for 2020 realpersonal taxes. More information can be found in the latest Assessor News Letter.

Disclaimer Madison County Treasurers Office 16 E 9th St. Visit the Clark County Property Tax Assessment Website. Printview your Property Record Card.

View and print Tax Statements and Comparison Reports. Indiana Gateway Local Tax Finance Dashboard QuickLinksaspx. If you are having trouble searching please.

Once you have entered information click. Taxpayers are entitled to only one Homestead Credit in the State of Indiana. Please direct all questions and form requests to the above agency.

Statements are mailed one time with a Spring A coupon and Fall B. I ssue mobile home moving permits and verify taxes for alcohol. Room 109 Anderson IN 46016 765 641-9645 Madison County Treasurers Office 16 E 9th St.

2019 pay 2020 property taxes are due May 11 2020 and November 10 2020. Deductions Your property may be eligible for deductions from the assessed. When you have selected your property you can.

Email or call him directly at 765-423-9385. This line will be highlighted in yellow and is the equivalent of the propertys gross assessed value as shown on the Notice of Assessment or Tax Bill. Tax statements are sent out once a year with both spring and fall copies included in that bill.

124 Main rather than 124 Main Street or Doe rather than John Doe. Perform a free Indiana public property records search including property appraisals unclaimed property ownership searches lookups tax records titles deeds and liens. Indiana is one of the lowest taxed states in the nation with an effective tax rate of just 081.

Pay Your Property Taxes Or View Current Tax Bill

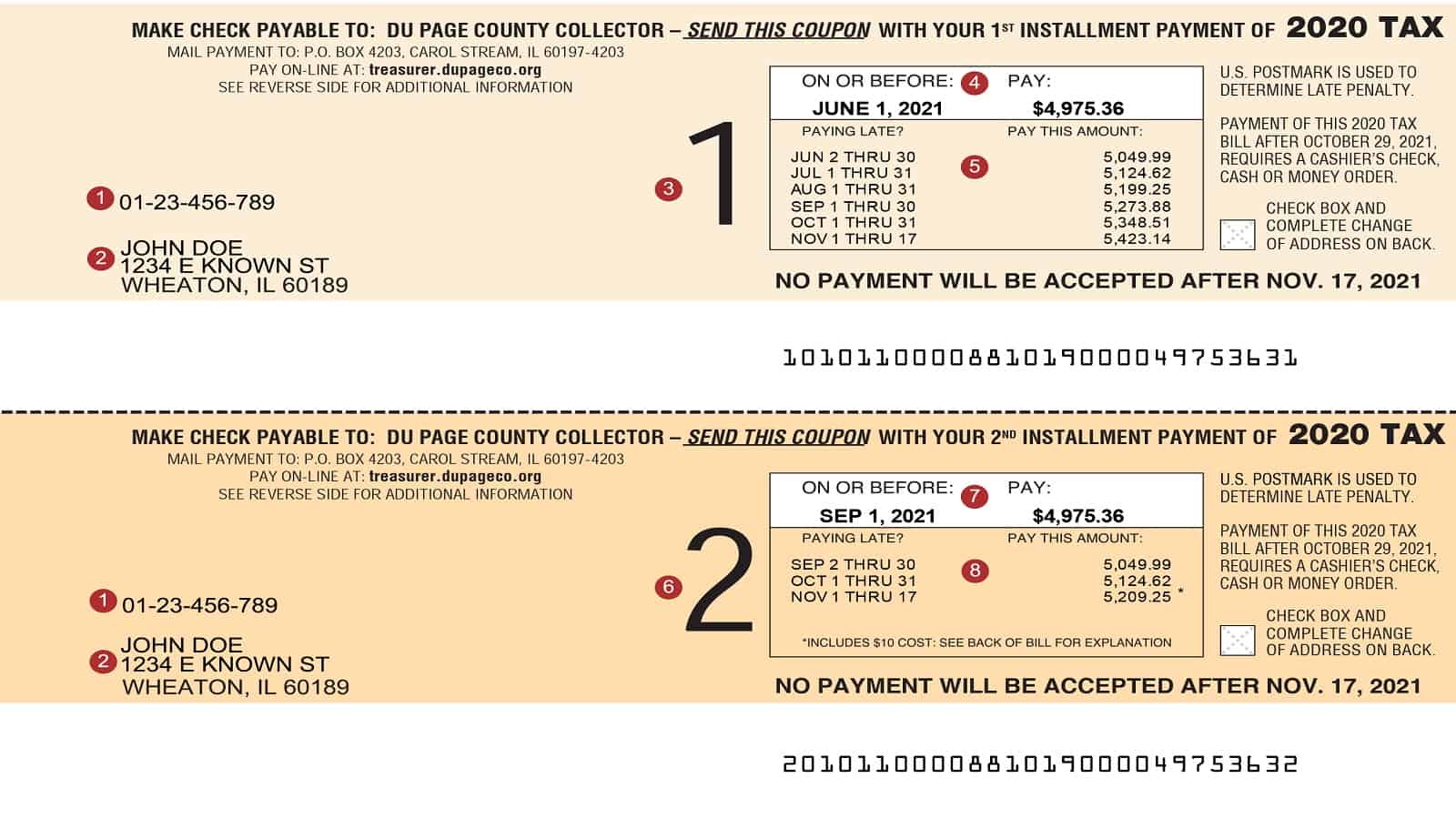

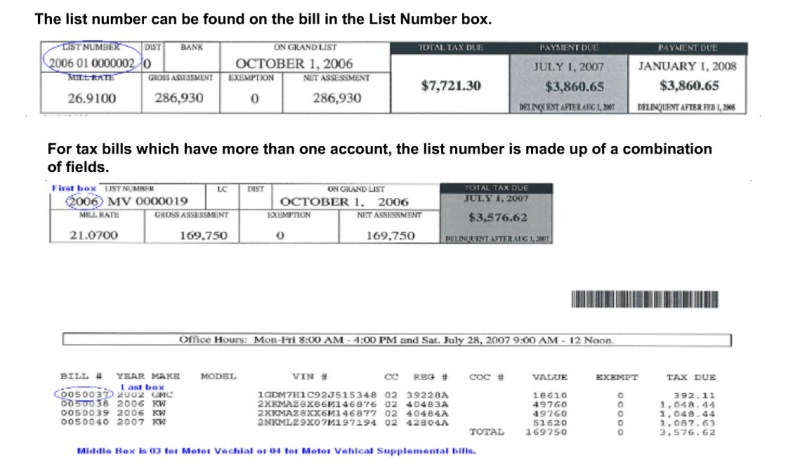

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

The New Age In Indiana Property Tax Assessment

Deducting Property Taxes H R Block

Property Tax Calculator Smartasset

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Guilford County Tax Department Guilford County Nc

Property Tax Search Taxsys Osceola County Tax Collector

Property Taxes By State Highest To Lowest Rocket Mortgage

Home Indiana Association Of Realtors

Pennsylvania Property Tax H R Block

City Of New Haven Tax Bills Search Pay

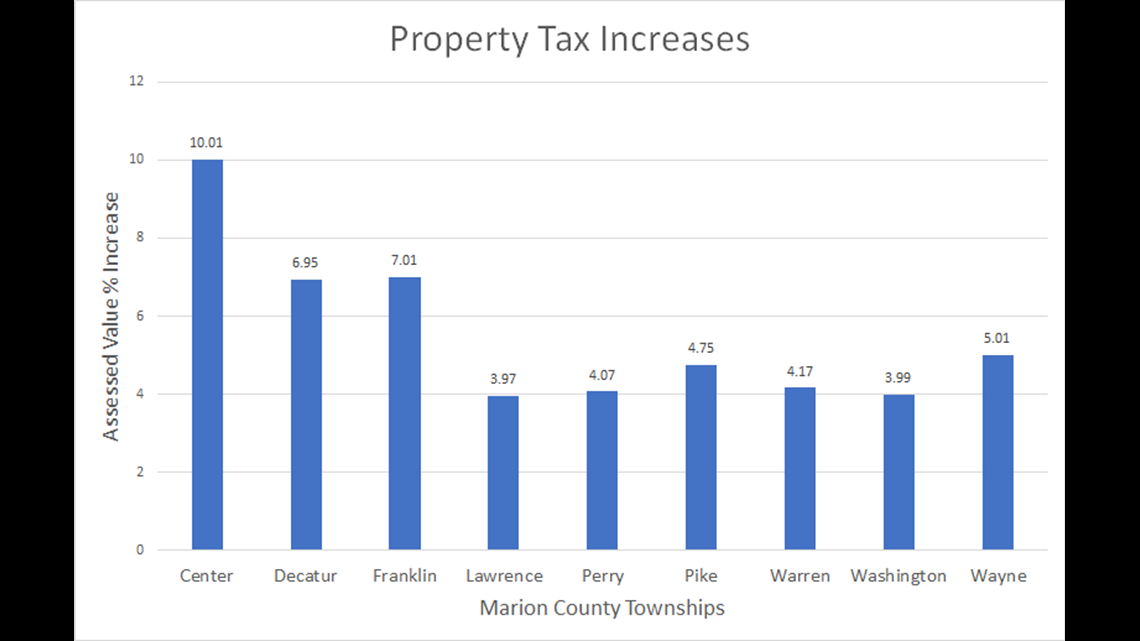

Why You Ll Likely Pay More In Property Taxes This Year Wthr Com