maryland tax lien payment plan

A tax lien may damage your credit score and can only be released when the back tax is paid in full. Check your Maryland tax.

When you respond to your state tax bill you may apply for a Maryland state tax payment plan by stating that you require one.

. In Maryland a creditor attaches a property lien to a debtors real or personal property to guarantee payment of debts. Acquire Valuable Properties Or Get 18-36 Interest. For individual tax liabilities call 410-260-7482 260-7623 or 1-800-MD-TAXES or e-mail sutmarylandtaxesgov for either tax.

Pay Your Taxes Today. Just remember each state has its own bidding process. Ad Tax Lien Certificates Yield Great Returns Possible Home Ownership.

The case began with a Montgomery County man Kenneth R. Pay these individual and business taxes here. Is protected by the.

You may use this service to set up an online payment agreement for your Maryland personal. This is an ongoing. Ad Unsure if You Qualify for ERC.

A tax lien can be linked to all of the taxpayers assets as well as property acquired in the future. Check your Maryland tax liens. The Comptrollers Office must protect the states interest when offering a lengthy payment plan by recording a tax lien in the appropriate circuit court.

Maryland tax lien payment plan. The IRS will demand most taxpayers to repay. Welcome to the Comptroller of Marylands Online Payment Agreement Request Service.

Complete Edit or Print Tax Forms Instantly. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Maryland tax lien payment plan.

Ad Access Tax Forms. Durations of 36 to 60 months are possible. Estimated Personal Income Tax.

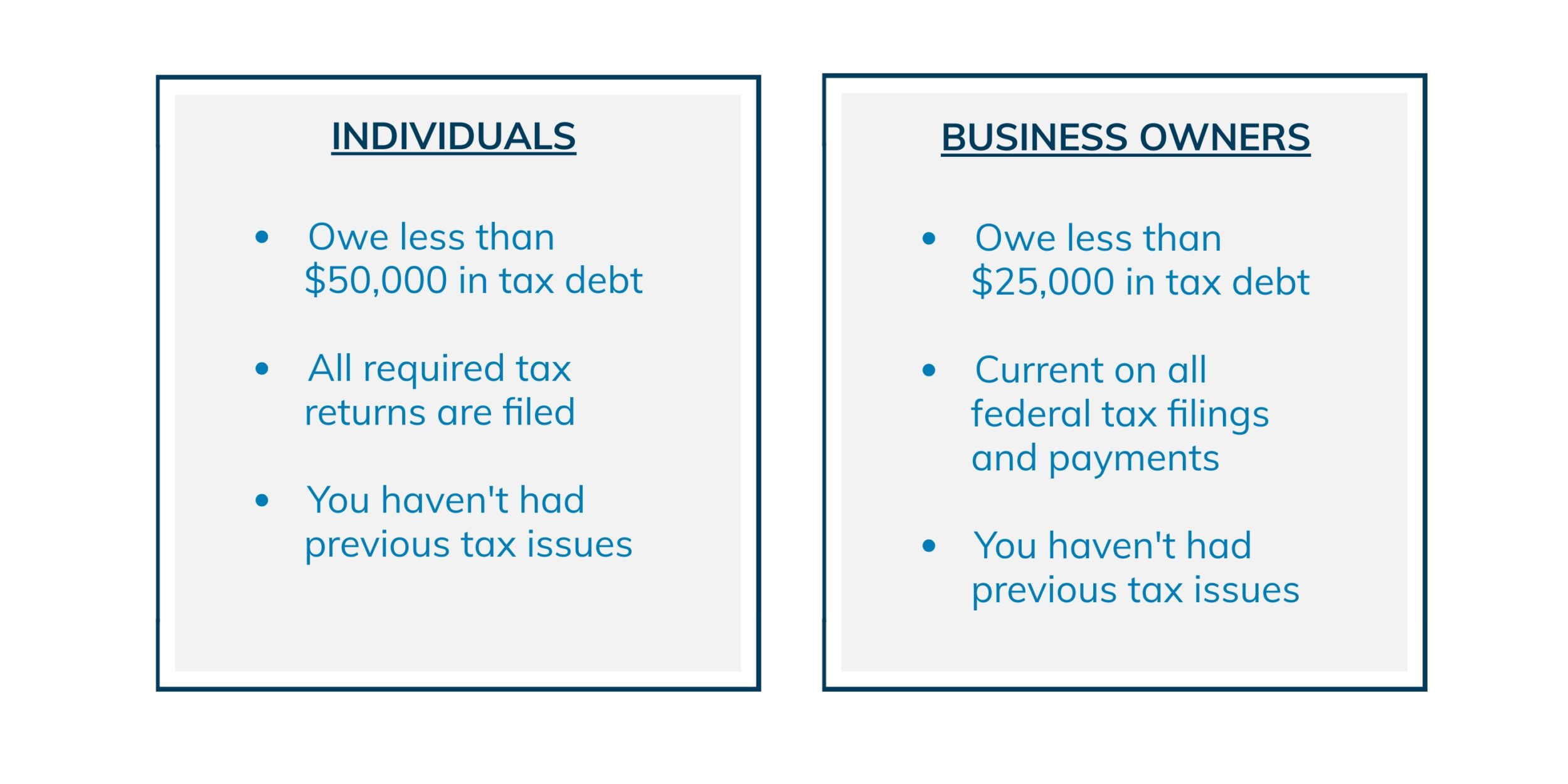

Taxpayers who owe past-due state taxes may be able to qualify for a. The Comptrollers Office must protect the states interest when offering a lengthy payment plan by recording a tax lien in the appropriate circuit court. For business tax liabilities call 410-767-1601.

In order to initiate a payment plan you need to make an initial down payment on each. Select estimated personal income tax personal. Different kinds of liens can be placed on a persons property.

Repayment terms can vary. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs. Talk to our skilled attorneys about the Employee Retention Credit.

If you have unpaid individual income taxes and are not in an approved payment plan you can request a payment arrangement online by email at. However for longer-term tax payment plans the controller could file a tax lien. Download or Email IRS 14135 More Fillable Forms Register and Subscribe Now.

Is protected by the. Generally if you dont have a lien you can get a 36-month payment plan with no financial required MD 433-A. Durations of 36 to 60 months are possible.

Does Owing The Irs Affect Your Credit Score Community Tax

How To Set Up An Irs Payment Plan Or Installment Agreement Jackson Hewitt

Apple Products Fan On Twitter Tax Forms Filing Taxes Tax Deductions

Payment Plan Agreement Awesome 11 Sample Payment Plan Templates To Download How To Plan Marketing Plan Template Contract Template

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Irs One Time Forgiveness Program Everything You Need To Know

Do I Qualify For The Irs Fresh Start Program

Sample Legal Will Freewillstoprint Com Last Will And Testament Will And Testament Funeral Planning Checklist

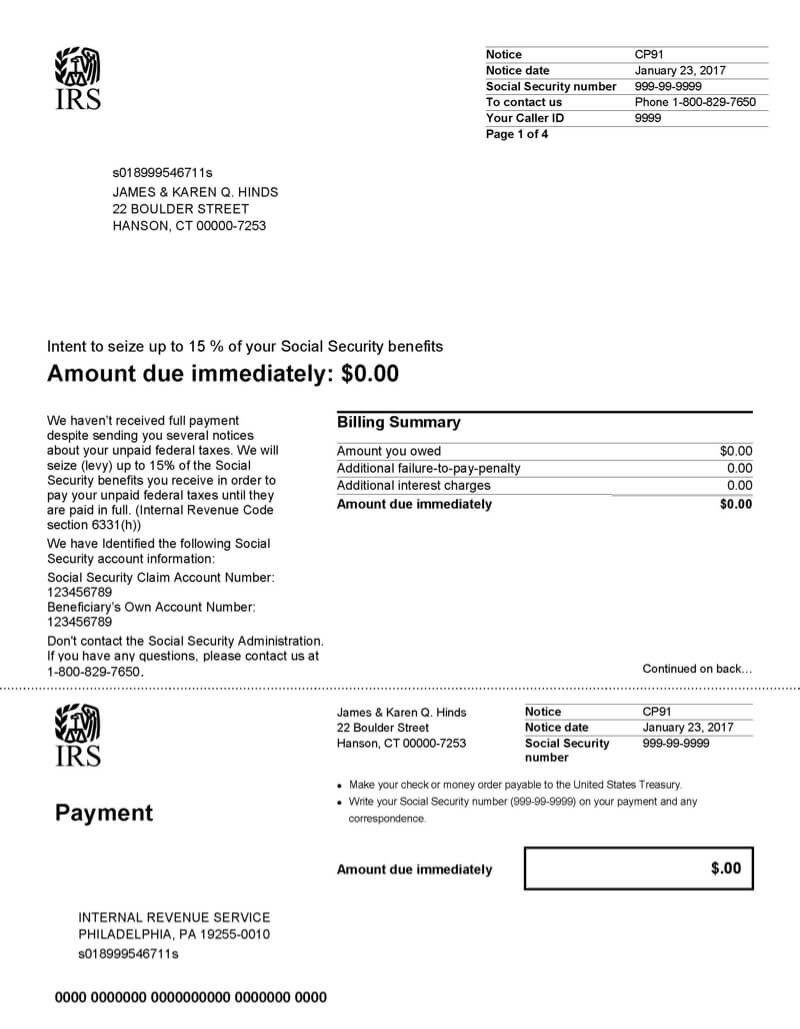

What Is A Cp91 Irs Notice Jackson Hewitt

Does Owing The Irs Affect Your Credit Score Community Tax